Corpay has once again been recognized on the prestigious Inc. 5000 List for the fourth consecutive year. This accomplishment highlights our commitment to growth, innovation, and providing exceptional service to our clients.

Corpay Payment Automation means faster payments for suppliers.

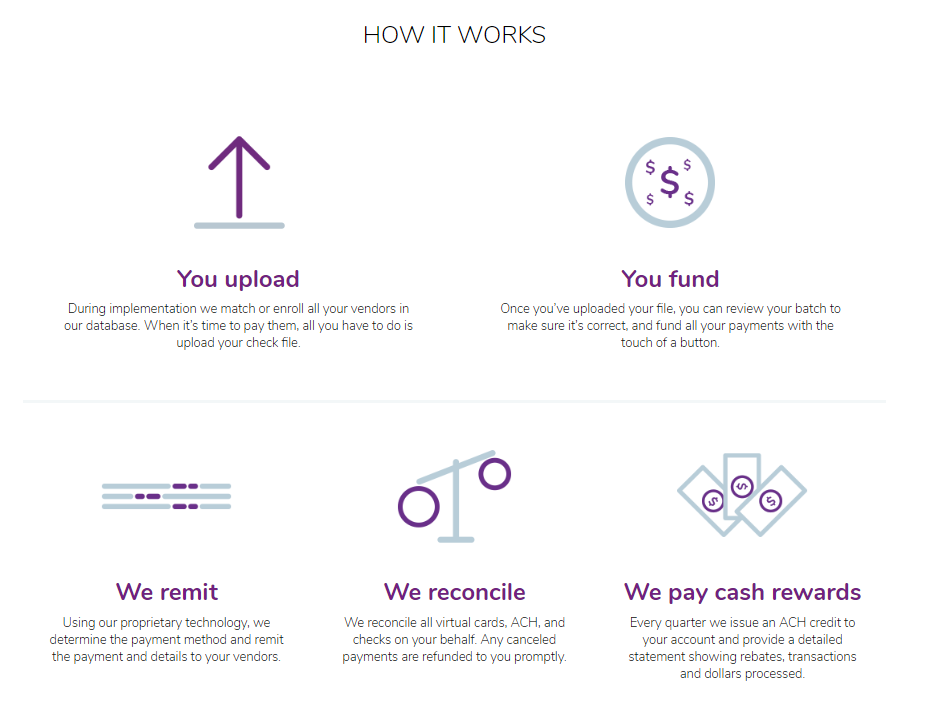

It’s just that simple.

Corpay processes billions in payments annually for clients around the country in diverse sectors including banking, education, healthcare, media, manufacturing and services. Our payment network spans 200,000+ suppliers from coast to coast, with 75% receiving electronic payments over traditional checks.

Protected payments. Proven profit.

By enrolling suppliers in electronic payments, we dramatically cut back the waiting time between when they submit an invoice and when they get paid. Not only that, but electronic payments reduce the risk of check fraud, and all payments made through our network are protected from fraud

With Corpay you get:

- Greater efficiency through processing and payment reconciliation

- Greater security through encrypted account data and two levels of authentication

- Greater speed though fast implementation and an easy-to-use interface

- Greater support through a dedicated team of payment specialists

A massive labor shortage is gripping corporate America. Higher wages, fat signing bonuses, staff training and other enticements only go so far with job seekers and employees. The key to attracting and retaining top talent in the finance office is to digitally transform the Accounts Payable (AP) function into a more rewarding and strategic role, where staff have the automated, personalized tools that they need to be productive anywhere. Click here to read the full article.

Case Study: Accounts Payable Processing Time Reduced 80%

A nonprofit senior living community shrank its accounts payable (AP) processing time by over 80%, thanks to a streamlined invoice and payment automation platform. By partnering with Corpay, Juliette Fowler Communities successfully transformed its own financial processes. The result? Efficiency gains, talent development, and enhanced cybersecurity measures. A new LeadingAge CAST case study, “Payment Automation Increases Staff Efficiencies and Reduces Processing Times,” details the transformation.

Testimonials:

“We’ve only been with Paymerang for a short time. I only wish we found out about it sooner! The fully automated system saves us time and money. The people are wonderful to work with. We signed up right at the start of COVID and they were very patient with us as we worked through the implementation. All while we were working from home. They do all the work with the vendor and make is so easy. This was a big Win Win!” – Harbor’s Edge

“Despite the COVID19 health crisis, we were able to implement Paymerang in about a month and streamline our entire accounts payable process – saving our accounting team valuable time and resources. The service has enabled us to work remotely if we have to and still make payments” – Westminster Canterbury Richmond

“My stress in my role has decreased. Normally I would spend between 5-6 hours every week cutting, stuffing, mailing checks and issuing credit card payments. I hated Thursday’s (my normal check cutting day) because I knew it meant I would be doing, what felt like, tedious work of stuffing envelopes. I’m also relieved that Paymerang is handling the countless hours reconciling vendor payments, reissuing checks/cards.” – AP Coordinator, Menno Haven

With Corpay, you get a new revenue stream without paying anything out of pocket for our services. Your suppliers get faster payments. And you can reclaim hundreds of ours for your finance team. It’s a win-win-win.

Read more on the Corpay blog.

Learn More About Corpay in the LeadingAge Buyer’s Guide.