Workforce Solutions for Nonprofits: A Program Designed to Safeguard Nonprofits

Workforce Solutions for Nonprofits

Are you looking for ways to reduce costs and optimize efficiency within your organization? Whether you’re trying to take control of unemployment costs or simply better manage unemployment claims—all while streamlining compliance practices and enhancing employee engagement, this webinar is for you.

Watch on-demand to discover the valuable services and special LeadingAge member benefits.

Access Tools to Manage UI Risk and Cut Costs

Nonprofit organizations nationwide have a unique opportunity to manage unemployment claims costs more effectively than their for-profit counterparts, potentially saving thousands of dollars every year. That’s why our long time partner, UST Workforce Solutions, created the 2025 Nonprofit UI Toolkit—a curated collection of tools and resources designed to help your nonprofit mitigate unemployment risk and claims costs while optimizing workforce strategies. They’ve got you covered with everything from how to protect your state unemployment tax rate, tips for preventing retaliation claims, and a state-by-state unemployment reference guide. You’ll also discover:

- · Fraud Prevention Tips: Avoid fraudulent unemployment claims and strengthen UI integrity

- · The Claims Lifecycle: Discover the ten steps of an unemployment claim

- · Hearing Best Practices: Master unemployment hearings with expert insight

- · Retention and Engagement Strategies: Strengthen your workforce and avoid turnover costs

- · Workforce Solutions: Hear exclusive insights from UST workforce experts

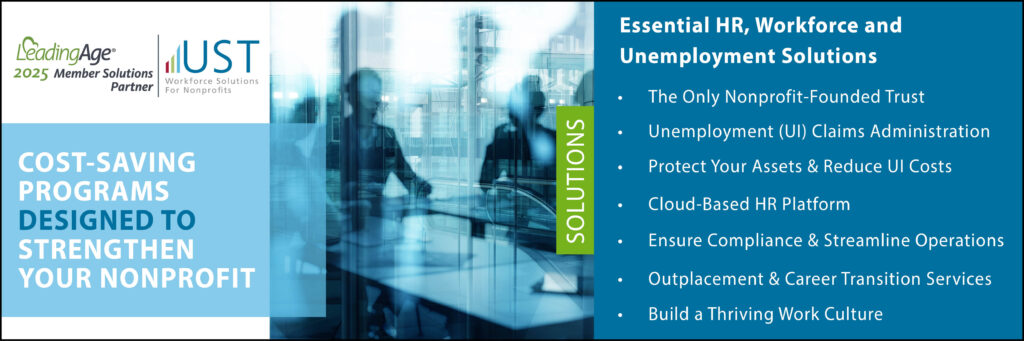

LeadingAge has partnered with UST Workforce Solutions since 2002 to provide essential HR, workforce, and unemployment funding and administration solutions that meet the unique needs of LeadingAge members. Equip your nonprofit with strategies that simplify unemployment claims management so you can focus on your mission with confidence.

Three Essential People-Centric Approaches to Cultivate Nonprofit Success

Download a free copy of UST’s latest eBook, People First: Strategies for Retaining and Supporting Nonprofit Employees, to discover three essential people-centric approaches that can help cultivate nonprofit success and enhance longevity.

Are You Overpaying?

With many states raising tax rates on unemployment funds that dwindled during the worldwide Pandemic of 2020, nonprofits could be paying as much as $2 in unemployment taxes for every $1 their former employees make in claims. By opting out of the state UI tax system, 501c3 organizations can potentially save thousands of dollars annually. Download UST’s “It’s All About the Numbers Infographic” to uncover the benefits of exercising this exclusive nonprofit tax alternative.