Expanding Housing Supply Will Rein in Inflation

The national housing shortage, economists say, is “one of the most critical drivers of inflation” and must be addressed. Economists argue that federal investment to expand the supply of affordable housing would reduce inflation.

“The [nation’s 1.7 million homes] shortfall has sent the cost of housing through the roof. Home prices have more than doubled over the past decade, rising close to 20 percent in the last year alone. And rents are up a record 13.5 percent nationwide over the past year, with increases of more than 20 percent in metropolitan areas such as Austin, Las Vegas, Phoenix and Tampa. All of this is draining the savings of renters, putting homeownership further and further out of reach. It is also putting enormous upward pressure on inflation,” economists Jim Parrott and Mark Zandi wrote in a January 2022 piece in The Washington Post.

“Skyrocketing housing costs may create even bigger problems for the administration going forward than oil and food price spikes, which are the result of sudden and unforeseen — but probably temporary — events. That’s because there’s no clear end in sight for shelter inflation,” a March 2022 article in Politico said. Home prices rose 18.8% in 2021, and rent has climbed 17.6% nationwide over the last year.

“If policymakers are serious about reining in inflation, then they have little choice but to take on the shortfall in housing supply,” Zandi and Parrott say. “This means improving the economics of building enough to overcome the costs that have been holding builders back in recent years. This can be done in any number of ways, including tax breaks, grants, access to less expensive capital and incentives to get local decision-makers to ease zoning rules and restrictions on development.”

The shortage of housing will not evaporate on its own. “While the other drivers of inflation are set to ease in the coming months, the shortfall in housing isn’t going anywhere unless policymakers do something,” Parrott and Zandi say.

“This is a problem everywhere — we’ve got a problem coast to coast in almost every community. I’m surprised at this point that housing hasn’t risen to the top of the political agenda already,” Zandi said in the Politico piece.

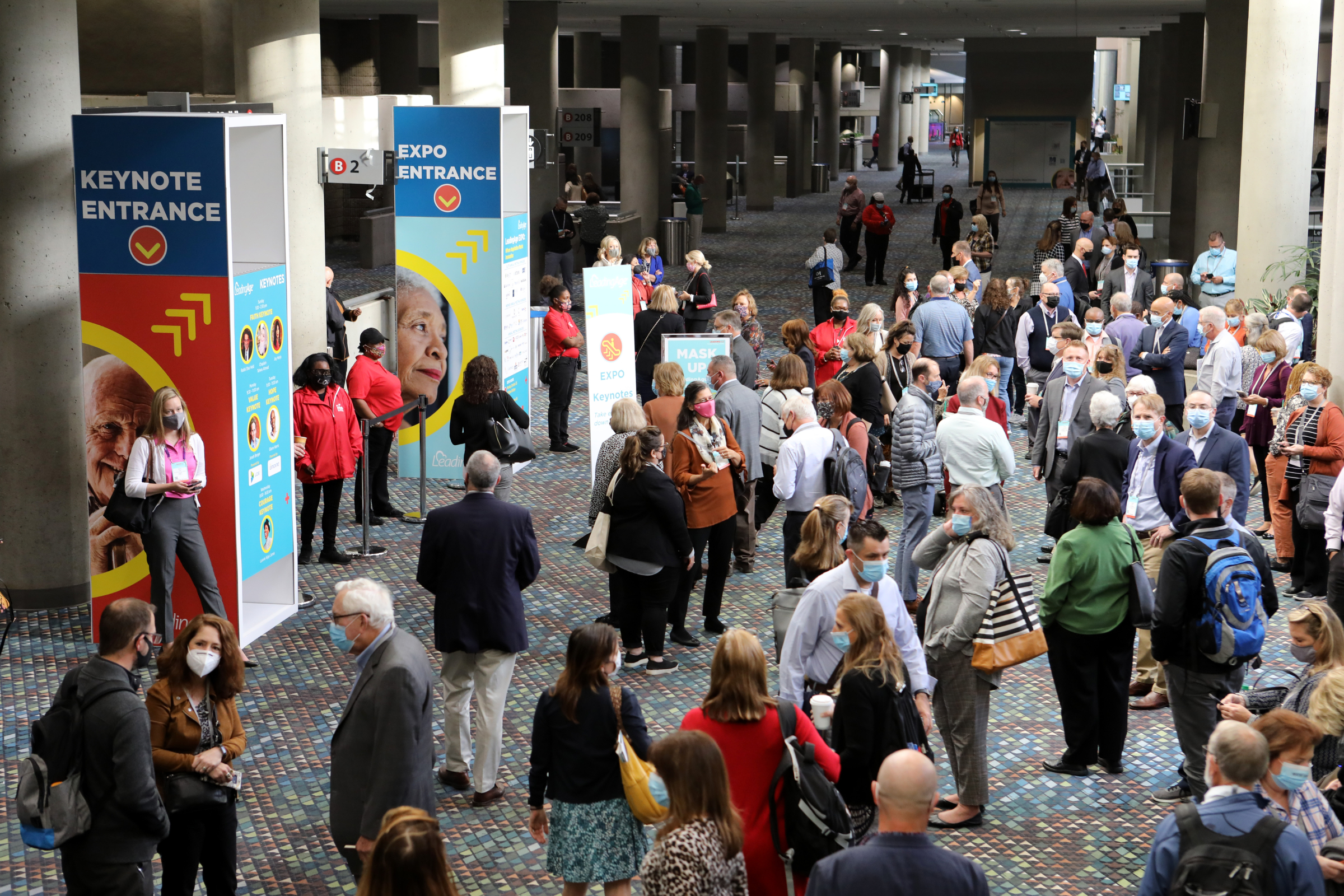

LeadingAge’s top housing priority is to expand the supply of affordable housing for older adults.

Background on the Consumer Price Index

Over the last 12 months, through February 2022, the Consumer Price Index has increased by 7.9%. According to the Bureau of Labor Statistics, which tracks the CPI, “The shelter index was by far the biggest factor in the increase.” The CPI measures the change in prices paid by consumers for goods and services. The CPI is based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).

Most Recommended

October 15, 2025

Shutdown Week Three: Impact of Ongoing Closure on Affordable Housing

Shutdown Week Three: Impact of Ongoing Closure on Affordable Housing

February 03, 2026

Fiscal Year (FY) Funding 2026

October 07, 2025

Immigrant Workforce Matching Program Brings Workforce Relief

Recently Added

February 04, 2026

Colleagues on the Move, February 4, 2026

Colleagues on the Move, February 4, 2026

February 02, 2026