Physical robots, health information exchanges (HIEs), and infection prevention solutions are on the rise at the nation’s biggest senior living providers, according to the 20th Annual LeadingAge Ziegler (LZ 200) report. The LZ 200 ranks the 200 largest not-for-profit senior living organizations in the country and outlines relevant business trends.

LeadingAge and Ziegler partner on this report each year. A LeadingAge Gold Partner with CAST Focus, Ziegler is the nation’s leading underwriter of financings for not-for-profit senior living providers. The report includes more than 200 providers of multi-site systems, more than 200 single-site campuses, and the largest multi-site providers of government-subsidized affordable housing.

Trending Technologies for the LZ 200

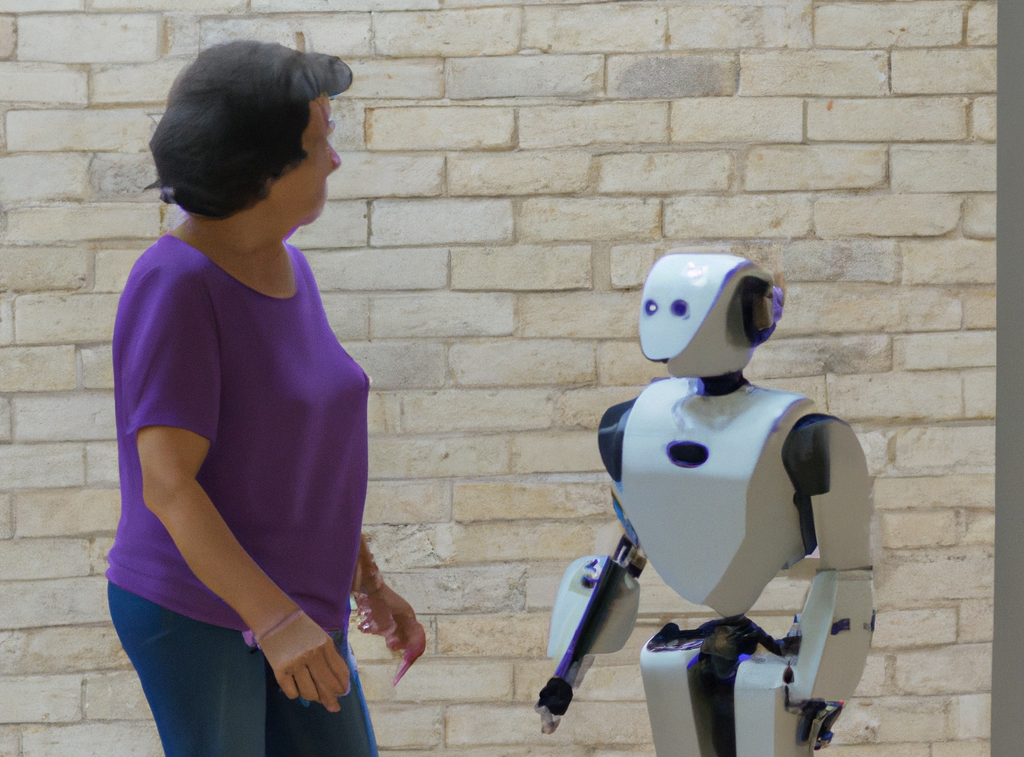

This year’s report finds a focus on robots, sharing and interoperability of health information, and pandemic-inspired infection prevention technologies.

- Physical Robots are Taking a Stand: Of the 47 respondents who reported adopting robotic technology, 70% are using physical robots, up from 43% last year. Only 30% said they use robotic process automation, as compared to 57% last year. When asked about the brand of robots they use, 18 of the 23 respondents use Bear Robotics Inc./Servi.

- Providers Continue to Join Health Information Exchanges (HIEs): The percentage of providers participating in HIEs continues to trend upward. The number of respondents who say they are not in HIEs has fallen steadily, from 42% in 2020, to 31% last year, to 28% this year. The ways in which they participate have not changed much since last year. The number who say they are in an HIE/network stands at 48% in 2022, only slightly below last year’s number of 46%. These numbers show a more-lasting trend away from HIE/Networks; in 2020, 65% of respondents said they were in an HIE/Network. The number of those who have direct connectivity remains fairly stable from last year to this year, at 24%.

- Adoption of Infection Prevention Technologies Continues to Rise: The 2022 survey showed the greatest adoption yet of Staff & Resident Screening Technologies and Infection Control Technologies, both at 55%. Those adoption percentages were at 49% and 48%, respectively, last year.

- Use of Electronic Documentation Technologies Trends Upward: The percentage of providers using electronic documentation technologies returned to levels seen in 2019 and 2020. Electronic Medical/Health Records (EMR/EHR) use rose from 66% in 2021 to 72% in 2022. Use of Electronic Point of Care/Point of Service Documentation Systems increased from 65% to 72% since last year.

Technologies that Remain a Priority

The following technologies experienced little change in adoption from 2021 to 2022, indicating they continue to be important solutions for supporting older adults.

Safety Monitoring Technologies:

- The majority of LZ 200 providers use Access Control/Wander Management Systems; the percentage grew from 62% to 69% in the past year.

- Adoption of Automatic Fall Detectors stayed fairly stable, at 33%.

Coordination Software & Resident Engagement Technologies:

- Use of Care/Case Management & Coordination Software grew from 53% to 57% in the past year.

- Use of Social Connectedness/Resident Engagement technologies grew slightly to 60%.

- Adoption of Advanced Analytic Tools rose slightly to 42%.

Health & Wellness Monitoring Technologies: Use of these technologies stayed relatively stable in 2022, with the biggest change being a 4% jump in adoption of medication monitoring technologies.

- Use of Telehealth/ Remote Patient Monitoring (RPM) stayed nearly stable, at 40%, and use of Telecare/ Telemonitoring/ Behavioral Monitoring lowered 3% to 16% since last year. These numbers have been relatively consistent over the past four years.

- Use of Physical Exercise and Rehabilitation Technologies stepped down from 56% in 2021 to 54% in 2022.

Type of EMR/EHR Technology

LeadingAge CAST partners provide the majority of EMR-EHR technology to the LZ 200. These partners received the most mentions:

- PointClickCare, LeadingAge Gold Partner with CAST Focus (72 mentions)

- MatrixCare, LeadingAge Silver Partner with CAST Focus (37 mentions)

- Netsmart/MyUnity, LeadingAge Bronze Partner with CAST Focus (26 mentions)

Tech Adoption Among Single-Site Organizations

Usage data for the largest 200 single-campus senior living communities appears separately in the LZ 200 report. Adoption is typically higher in these organizations, with results as follows:

- Electronic Medical/Health Records System – 96%

- Electronic Point of Care/Point of Services Documentation Systems – 94%

- Access Control/Wander Management Systems – 94%

- Physical Exercise & Rehabilitation Technologies (other than PT, OT equip) – 81%

- Resident Social Connectedness/ Engagement Platforms – 78%

- Medication Management Technologies – 79%

- Care/Case Management and Coordination Software Tools – 72%

- Telehealth/Remote Patient Monitoring – 34%

- Automatic Fall Detectors – 35%

- Staff and Resident Screening – 69%

- Infection Control Systems – 67%

- Advanced Analytical Tools – 34%

- Robotic Applications – 20%

LeadingAge CAST Members in the LZ 200

This year’s report represents more than 306,000 market-rate units and nearly 1,600 market-rate communities across the country. Numbers are reported as of Dec. 31, 2022.

Several of the 10 largest not-for-profit multi-site senior living organizations are LeadingAge CAST Patrons:

For more interesting findings, access the LZ 200 report.

Shutdown Week Three: Impact of Ongoing Closure on Affordable Housing

Shutdown Week Three: Impact of Ongoing Closure on Affordable Housing