Unpacking the Wage Dilemma in Aging Services

Most of us work in aging services because we have a real passion for serving older adults. Often, when we talk to people about how they got started in this field, caregivers respond with a story about a beloved grandparent, or volunteering as a candy-striper long ago, or starting out in the kitchen of a nursing home as a teenager. Caregivers stay in this field because they love the people they care for, and because older adults need care.

Professional caregivers certainly don’t stay in this field because of the pay. As LeadingAge’s LTSS Center @UMass Boston found, our society does not value this work, and wages are not commensurate with the level of expertise and skill required of caregivers. A study from PHI notes that 43% of caregivers receive some kind of public assistance, and 40% live in low-income households. In 2021, the median hourly wage for professional caregivers in the United States was $14.27 and that included significant federal investments in workforce and Medicaid programs from COVID-19 relief efforts.

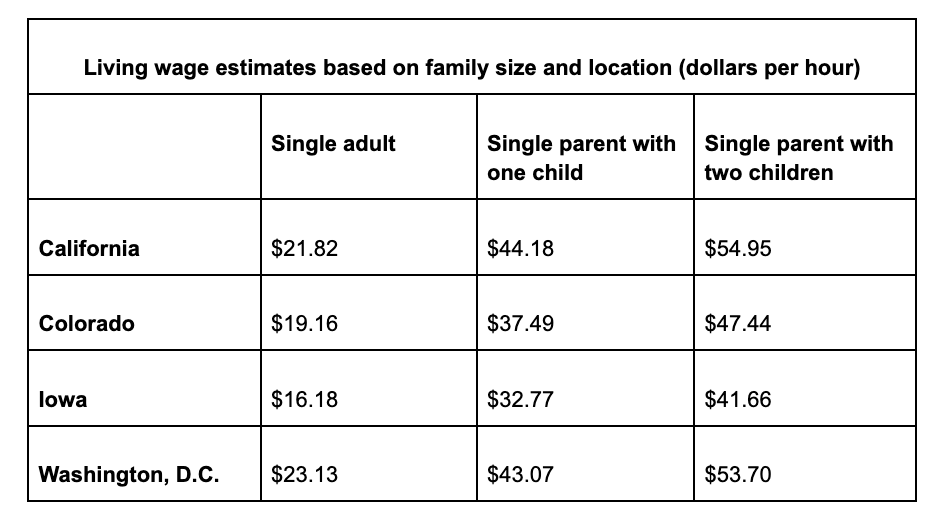

So, when we look at a living wage across the country, we understand how the caregiving workforce is so likely to live in poverty. When food, childcare, health care costs, housing, transportation, and other necessities are tallied, a real living wage is much higher than the median wage of our workers. As noted by the MIT Living Wage calculator, a sampling of living wages across the United States are a far cry from $14-15 an hour.

Of course, the ability to provide a living wage hinges upon fair and adequate Medicaid reimbursement, as Medicaid is the primary payor for aging services organizations. Funding to contribute to a living wage has a hefty price tag but comes with serious financial savings as well. In a 2020 report, Making Care Work Pay, the LTSS Center @UMass Boston demonstrated how higher pay for the caregiving workforce would result in overall economic growth, as caregivers would have increased income to purchase necessities in local businesses, contributing up to $22 billion to local economies. Beyond that, the report estimates $1.6 billion in total savings across public assistance programs and tax credits.

Perhaps most importantly, low wages can impact staff’s personal and professional well-being. A 2018 report from the Federal Reserve System noted that 40% of adults cannot cover an unexpected expense of $400, and more than 20% of adults cannot fully cover their typical monthly expenses. That level of instability has a broad impact. The 2018 stable Jobs – Unstable Lives report from the Institute for Poverty Research at University of Wisconsin Madison shares that a lack of financial stability leads to:

1. Difficulty arranging childcare

2. Adverse health outcomes

3. Lack of stable sleep

4. Lower food security

5. Difficulty in maintaining work-life balance

6. Long-term psychological distress and poor mental health

Adding a layer of complexity is the benefits cliff, which the National Conference of State Legislatures (NCSL) defines as, “the sudden and often unexpected decrease in public benefits that can occur with a small increase in earnings…When lost benefits outpace a wage increase, many families ‘park’ or fall off the cliff’s edge, stalling progression in their jobs and careers.” As noted earlier, with 43% of aging services caregivers relying upon public assistance programs, our staff can easily get “parked” in the benefits cliff – afraid to take on more hours and hesitant to advance in their careers. The NCSL has well documented examples from around the country, highlighting tools, policy recommendations, and partnership models to begin to address this complex issue.

Without federal and state reimbursement that reflects the training, skill, responsibility, and demand for services, providers are seemingly left to solve this problem on their own. Many organizations have done everything in their power to raise wages using cash reserves, lines of credit, COVID-19 related funding, and other partnerships to recruit, retain, and thank staff for their service during the pandemic. They have looked at non-wage benefits to try to support staff beyond pay. These examples are a good step, but still aren’t enough. We need to influence policymakers to invest substantial increases year-over-year until we hit a living wage, with a continuous re-evaluation requirement to ensure we keep up with inflation and labor force competition so that we aren’t left behind again in the future.

But what can we really do?

One-time ARPA funds aren’t going to cut it. Medicaid alone likely cannot support the overhaul needed to pay a living wage at the federal level. The benefits cliff is supremely complex and solutions will vary because of the specific mix of federal and state policies within each state. Employers are exhausted and aging services providers are experiencing dire financial strain. Addressing the compensation and benefits crisis in caregiving will take federal-state-local-employer level partnerships to move forward to solutions.

Your organization can start by:

· Having frank conversations with your Board of Directors. Has your organization done everything you can internally to improve compensation and benefits?

· Reviewing your current budget. Are you being efficient? Are there any areas you can re-distribute towards wages, or ways to redistribute C-Suite increases towards frontline? Is your organization able to contribute more toward benefits to afford more caregivers the opportunity to participate in health insurance?

· Talking to staff. Be honest with your teams about your organization’s goals to achieve a living wage to build trust and hope, as well as providing non-wage benefits that would help support stability in their lives. Meals to take home to their families? Access to laundry services? A gently-used clothing closet? Transportation vouchers? Find out what your team members need and deliver.

· Advocating for policy change at all levels. Are there opportunities at the local level to raise levies, other resources, or partnerships to increase wages? Has your organization reached out to policy makers at the state and federal level about recalibrating our financing system to support family-sustaining wages for our staff? Check out LeadingAge’s Aging Services Workforce NOW! campaign and talk to your lawmakers.

· Doing your research. Learn what is working in other states, proposed policy language, and benefits cliff advocacy.

The stress and mental load of poverty impact the physical and emotional health of our caregivers and, in turn, impacts the quality of care and access to care for older adults. The solution is complex, but the unified voice of LeadingAge members can make a difference. Join us in this conversation and help make change for those who have a passion for serving older adults.

Most Recommended

October 15, 2025

Shutdown Week Three: Impact of Ongoing Closure on Affordable Housing

Shutdown Week Three: Impact of Ongoing Closure on Affordable Housing

February 24, 2026

Fiscal Year (FY) Funding 2026

October 07, 2025

Immigrant Workforce Matching Program Brings Workforce Relief

Recently Added

February 26, 2026

Key Takeaways from President Trump's State of the Union

February 26, 2026

Vance, Oz Announce Medicaid Funding Withheld From Minnesota

Vance, Oz Announce Medicaid Funding Withheld From Minnesota

February 25, 2026

CBO: HR 1 Speeds Medicare Part A Insolvency by 12 Years

February 24, 2026