May 8, 2025

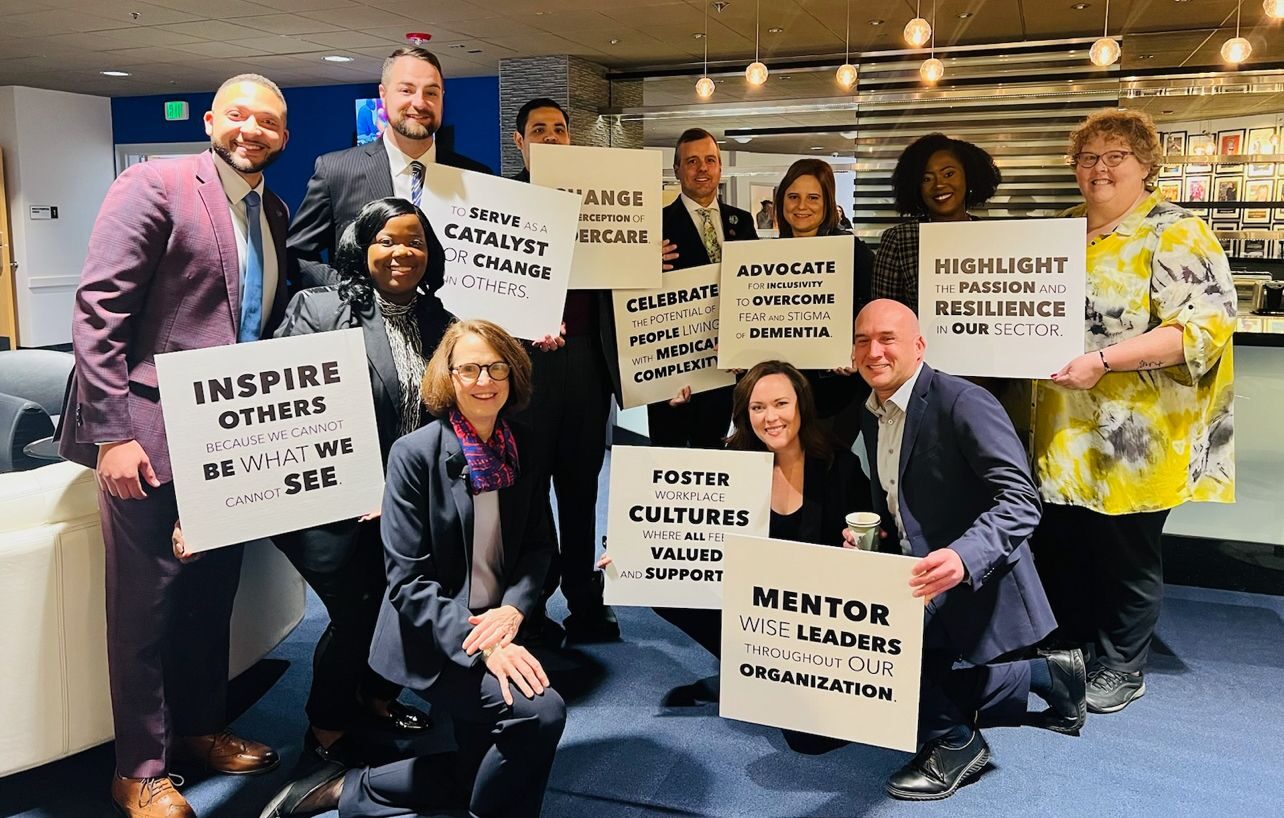

National Advocacy: Budget Reconciliation: Early May Round-Up and Analysis

As the House works on budget proposals affecting federal Medicaid spending, LeadingAge’s policy team outlines the state of play and a timeline of what’s to come in the near term.

LEARN MORE